Debt can be overwhelming, especially when juggling multiple payments. That’s where debt consolidation comes in. It simplifies your financial life by merging debts into one manageable loan.

Traceloans is a platform that specializes in this service. They offer tailored solutions to help you regain control over your finances. With competitive rates and personalized options, Traceloans aims to ease your debt burden.

Understanding how Traceloans works can be a game-changer. It provides tools and support to streamline your debt management. This guide will explore the benefits and process of using Traceloans for debt consolidation.

Discover how Traceloans can help you achieve financial stability and peace of mind.

What Is Debt Consolidation and Why Does It Matter?

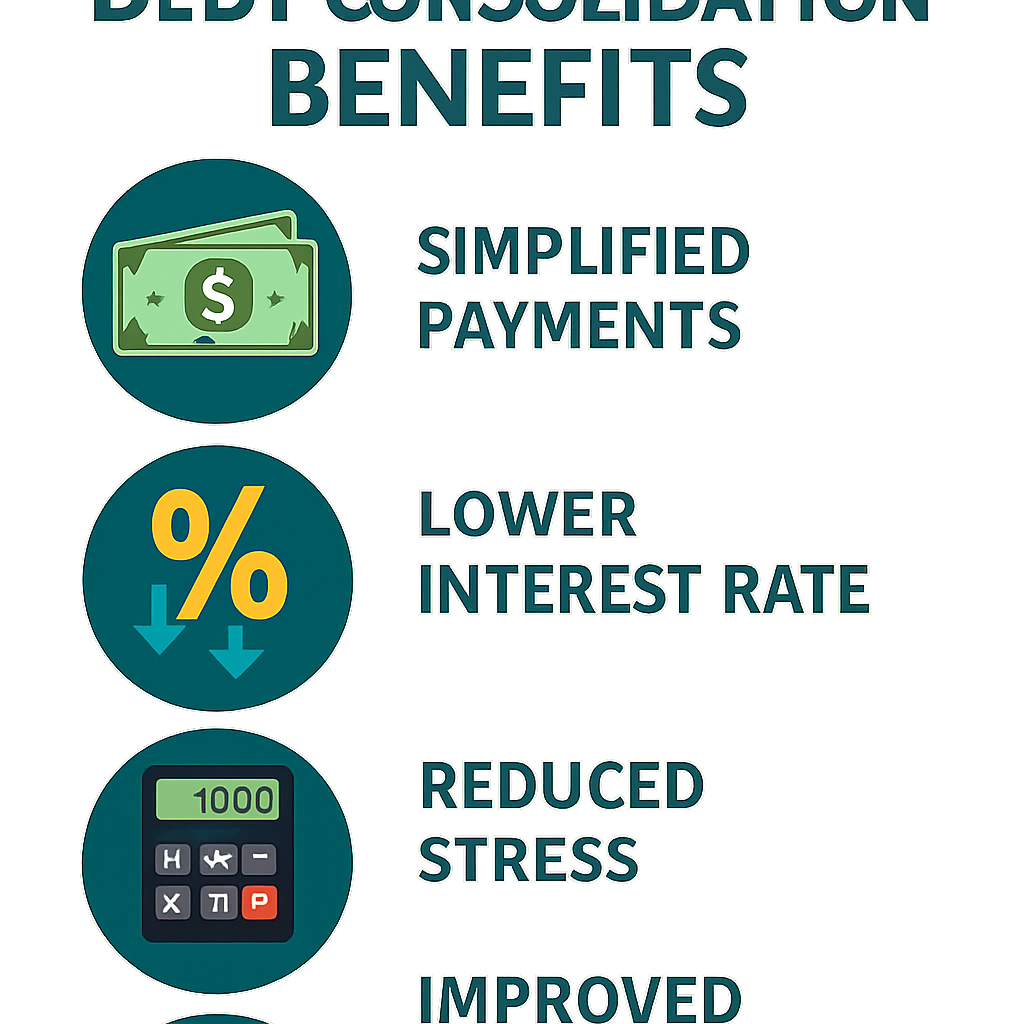

Debt consolidation is a financial strategy. It combines multiple debts into one loan with a lower interest rate. This means you pay one monthly bill instead of several.

The process is crucial for simplifying your payment schedule. It can also help you save money over time. By reducing interest rates, you decrease the total cost of your debt.

Moreover, debt consolidation can positively impact your credit score. Making timely payments on your consolidated loan boosts your credit over time. This improvement helps when applying for future loans.

Here’s why debt consolidation matters:

- Simplifies financial management

- Lowers overall interest rates

- Improves credit score over time

It’s essential to understand all terms before proceeding. Not every debt consolidation option suits everyone. Consideration and planning ensure success in using this financial tool.

In summary, debt consolidation offers many benefits. It’s a practical way to manage and potentially resolve debt. Using a reliable service like Traceloans makes the process more efficient and less stressful.

Overview of Traceloans: Who They Are and What They Offer

Traceloans is a renowned platform dedicated to debt consolidation. They offer personalized financial solutions to help manage your debts. Their services aim to simplify and streamline debt payments.

What sets Traceloans apart is their user-friendly approach. They provide tools that make managing consolidated loans easy. This helps customers stay on top of their financial game.

Traceloans offers several key features, including:

- Competitive interest rates

- Tailored repayment plans

- Comprehensive customer support

Using Traceloans, clients can access a variety of educational resources. These resources help improve financial literacy and management skills. The goal is to empower users for better debt control and financial independence.

Traceloans stands out by ensuring transparency in all their services. This transparency builds trust and confidence in their client relationships. Understanding your financial situation is a priority for them, making their approach both comprehensive and client-centric.

How Traceloans.com Debt Consolidation Works

Traceloans makes debt consolidation accessible and straightforward. The platform allows you to combine multiple debts into one loan. This reduces your monthly payment burden significantly.

The process begins with a simple online application. You’ll need to provide details about your existing debts. Traceloans uses this information to tailor solutions to fit your needs.

Once approved, your debts are consolidated into a single loan. This new loan often has a lower interest rate. Thus, you start paying less each month than before.

Key benefits of consolidating debt with Traceloans include:

- Lower monthly payments

- Simplified debt management

- Reduced stress from numerous bills

Traceloans also offers tools for tracking and managing loans. This ensures you stay informed and organized. The online dashboard is intuitive and easy to navigate.

Customer support is available to answer questions during the process. Traceloans aims to offer peace of mind with their reliable service. Their expertise helps you regain control over your financial life.

Key Features of Traceloans Debt Consolidation Services

Traceloans offers standout features tailored to various needs. These features make debt management simpler and more efficient. Here’s what you can expect from their services.

One of the main features is competitive interest rates. These rates can offer significant savings over time. Additionally, they provide flexible repayment plans that suit different financial situations.

Notable features of Traceloans include:

- Personalized debt relief options

- Transparent fee structures

- Educational resources on financial literacy

Traceloans also stands out with exceptional customer support. Their team assists you throughout the consolidation process. They make understanding and managing your debt manageable and stress-free.

Step-by-Step Guide: Using Traceloans for Debt Consolidation

Getting started with Traceloans for debt consolidation is simple. The process is designed to be user-friendly and efficient. Here’s a step-by-step guide to help you through.

First, gather all relevant information about your debts. This includes balances, interest rates, and creditors’ details. Having this data ready will facilitate a smooth application process.

Next, visit Traceloans.com and fill out the online application form. Input the necessary information accurately. This will help Traceloans tailor the best consolidation options for you.

Once submitted, a Traceloans representative will review your application. They analyze your financial situation to offer the best possible solution. You’ll receive feedback promptly.

If approved, you can review the proposed consolidation plan. Make sure you understand the terms and interest rates offered. It’s crucial to be fully informed before committing.

The next step involves accepting the consolidation offer. This merges your debts into a single loan. You’ll now have one predictable monthly payment.

Finally, utilize Traceloans’ tools to manage your new loan. Their online platform is intuitive and detailed. Track your payments and progress easily.

Important Steps in Traceloans’ Process:

- Gather debt information

- Complete the online form

- Review Traceloans’ feedback

After consolidating, stay proactive. Regularly check the platform for updates and advice. Take advantage of the educational resources offered to remain informed.

Common Mistakes to Avoid:

- Providing inaccurate information

- Overlooking terms and conditions

- Failing to manage payments actively

By following these steps, you can simplify your financial obligations. Traceloans strives to make the journey toward debt-free living efficient and supportive.

Pros and Cons of Traceloans Debt Consolidation

Debt consolidation can be a lifesaver, but it’s essential to weigh the benefits and drawbacks. Traceloans offers unique advantages, but it’s not without its downsides. Understanding both can guide your decision.

Pros:

- Simplified Payments: Consolidate several debts into one monthly payment.

- Lower Interest Rates: Potentially reduce the overall cost of your debt.

- Improved Credit Score: Timely payments can enhance your credit.

Traceloans aims to make financial management less stressful through competitive rates and support. By merging debts, you can focus on one payment, alleviating confusion.

Cons:

- Eligibility Requirements: A credit check might be required.

- Fees and Charges: Be aware of any associated fees.

- Commitment to Long-term: It’s a long-term solution requiring dedication.

Despite the benefits, it’s crucial to consider the long-term financial commitment. Fees may affect the total cost, so review all terms carefully. Understanding both sides will ensure you make the right choice for your debt relief needs.

Comparing Traceloans to Other Debt Relief Options

Choosing the right debt relief option is critical. Traceloans provides debt consolidation as a viable solution. But how does it stack up against other methods?

Debt consolidation involves merging debts for a single, manageable payment. This option can lower stress. However, other debt relief options also exist. These include balance transfer cards, bankruptcy, and debt settlement. Each has distinct features and requirements.

Key Comparisons:

- Balance Transfer: Low introductory rates, but limited to credit card debts.

- Debt Settlement: Negotiates debts lower, but may damage credit scores.

- Bankruptcy: Discharges debts, but with severe credit impact.

Traceloans focuses on making debt consolidation straightforward. Its user-friendly approach sets it apart. It’s crucial to evaluate your financial situation and goals. Whether Traceloans or another option is best depends on your unique needs. Consider how each option affects your finances and credit in the long term. This careful assessment aids in making the most informed decision.

When Should You Consider Debt Consolidation with Traceloans?

Debt consolidation is not for everyone, but it suits certain situations well. Understanding when to choose Traceloans is key.

Consider debt consolidation if you have multiple high-interest debts. Combining them could lower your overall interest. This can lead to savings over time.

Another scenario is struggling with managing several payments. Debt consolidation simplifies this into one. It’s also helpful if you’re aiming to improve credit by ensuring timely payments.

Ideal Scenarios for Traceloans:

- Paying multiple credit cards monthly.

- Looking for a lower interest rate.

- Wanting a single, easier payment.

- Seeking credit score improvement.

Evaluate your financial picture before deciding. Make sure consolidation aligns with your goals for stability and peace of mind.

Tips for Successful Debt Management After Consolidation

Debt consolidation is only the first step. Success depends on good management afterward. Implementing practical steps can lead to financial stability.

Maintaining disciplined financial habits post-consolidation is crucial. This will ensure your financial progress continues. Managing debt effectively prevents future issues.

Practical Tips:

- Create a comprehensive budget and adhere to it.

- Set aside savings for unexpected expenses.

- Regularly review your financial situation and adjust strategies.

Commit to these habits for sustained benefits. By staying proactive, you can regain control and steer clear of new debts.

Frequently Asked Questions (FAQs)

What is debt consolidation?

Debt consolidation involves combining multiple debts into one. This simplifies payments and often reduces interest rates.

How does Traceloans differ from other services?

Traceloans offers personalized solutions. They emphasize user-friendly tools and customer support.

Is my credit score affected by debt consolidation?

Initially, it might dip. However, with consistent payments, your score can improve over time.

Are there eligibility requirements for Traceloans?

Yes, a credit check is typically required. This determines your loan eligibility.

What types of debt can be consolidated?

Credit card and personal loans are common. Traceloans may offer options for other debts too.

Do I need professional advice?

Consulting a financial advisor is beneficial. They help assess if consolidation fits your situation.

How long does the consolidation process take?

Timelines vary based on each case. It’s important to discuss this with Traceloans directly.

Is there ongoing support from Traceloans?

Yes, Traceloans provides guidance throughout. They’re committed to assisting clients on their journey.

Conclusion: Is Traceloans Right for Your Debt Relief Journey?

Deciding on debt consolidation requires thoughtful consideration. Traceloans offers a unique blend of personalized service and robust tools. Their platform simplifies managing debts efficiently.

Traceloans stands out by offering flexibility and customer support. However, ensure their services align with your financial goals before committing. They provide clear terms, but every situation is unique.

Ultimately, Traceloans could be your path to financial relief. Evaluate your debts, explore options, and take control of your financial future. Aim for a debt-free life with informed choices.

You May Also Like: Crypto30x.com Gigachad